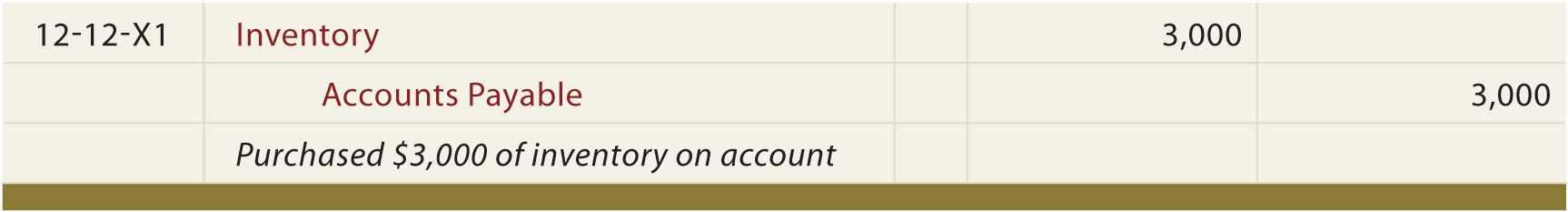

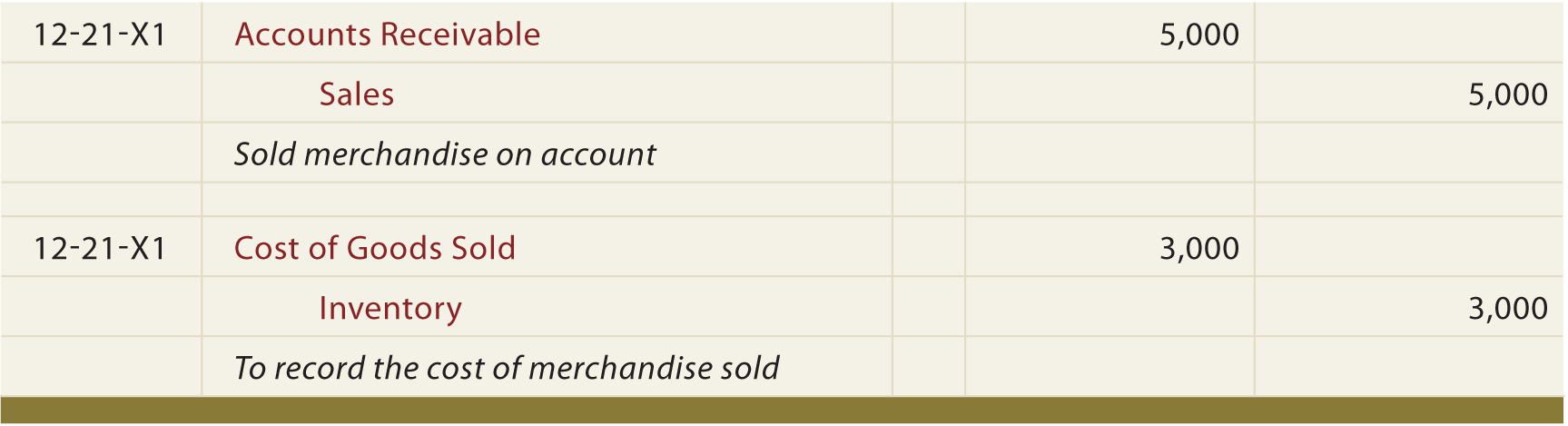

| The periodic system only required the recording of inventory purchases to a Purchases account; inventory records were updated only during the closing process based on the results of a physical count. No attempt is made to adjust inventory records concurrent with actual purchase and sale transactions. The weakness of the periodic system is that it provides no real-time data about the levels of inventory or gross profit data. If inventory is significant, the lack of up-to-date inventory data can be very costly. Managers need to know what is selling, and what is not selling, in order to optimize business success. That is why many successful merchants use sophisticated computer systems to implement perpetual inventory management. Bar code scanners at a retail checkout not only facilitate speedy transactions but may also be linked to an accounting information system. With a high-performance perpetual system, each purchase or sale results in an immediate update of the inventory and cost of sales data in the accounting system. The following entries are appropriate to record the purchase and subsequent resale of an inventory item: Entry to record purchase of inventory:  Entries to record sale of inventory:   With the perpetual system, the Purchases account is not needed. The Inventory account and Cost of Goods Sold account are constantly being adjusted as transactions occur. Freight-in is added to the Inventory account. Discounts and returns reduce the Inventory account. Therefore, the determination of cost of goods sold is determined by reference to the account's general ledger balance, rather than needing to resort to the calculations illustrated for the periodic system. If the perpetual system looks simpler, don't be deceived. Consider that it is no easy task to determine the cost of each item of inventory as it is sold, and that is required with a perpetual system. In a large retail environment, that is almost impossible without a sophisticated computer system. Nevertheless, such systems have become commonplace. This has come about with the decline in the cost of computers. One final point should be noted. No matter how good the computer system, differences between the computer record and physical quantity on hand will arise. Differences are created by theft, spoilage, waste, errors, and so forth. Therefore, merchants must occasionally undertake a physical count, and adjust the Inventory accounts to reflect what is actually on hand. |

Wednesday, February 16, 2011

An alternative inventory system: The perpetual method

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Thanks For Comment!!