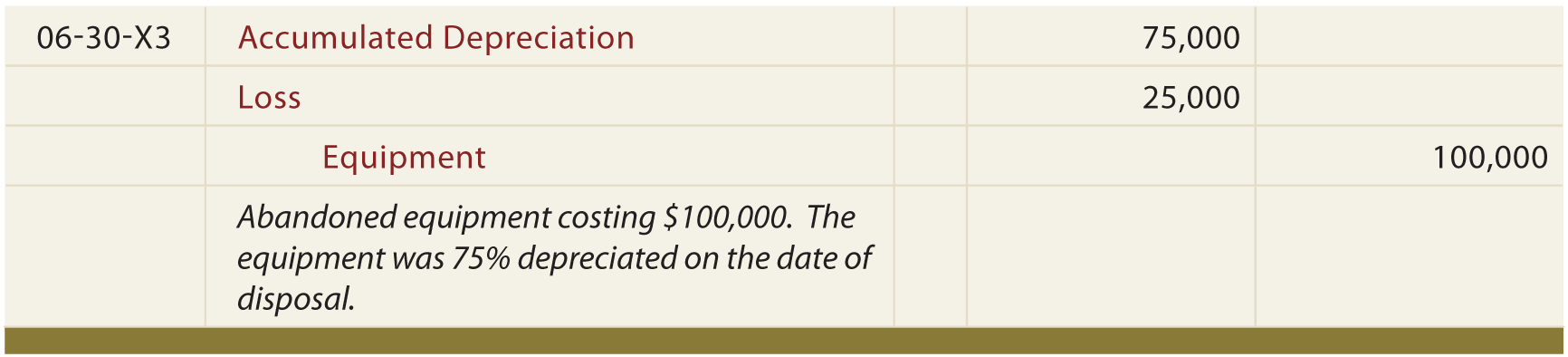

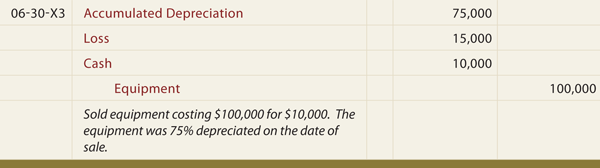

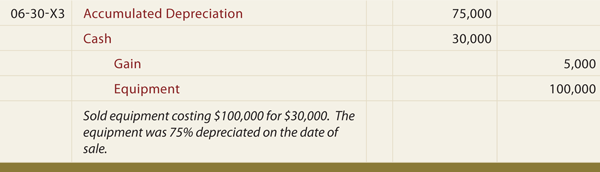

| Assets may be abandoned, sold, or exchanged. In any case, it is necessary to update depreciation calculations through the date of disposal. Then, and only then, would the asset disposal be recorded. If the asset is being scrapped (abandoned), the journal entry entails the elimination of the cost of the asset from the books, removal of the related accumulated depreciation, and potentially recording a loss to balance. This loss reflects the net book value that was not previously depreciated:  On the other hand, an asset may be disposed of by sale, in which case the journal entry would need to be modified to include the proceeds of the sale. Assume the above asset was sold for $10,000. The entry would be as follows:  While the journal entry alone might be sufficient to demonstrate the loss calculation, one might also consider that an asset with a $25,000 net book value is being sold for $10,000. This gives rise to the loss of $15,000. Conversely, what if this asset were sold for $30,000? Following is the entry for that scenario, which reflects a $5,000 gain:  |

Monday, February 21, 2011

Appropriate methods to measure and record the disposal of PP&E

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Thanks For Comment!!