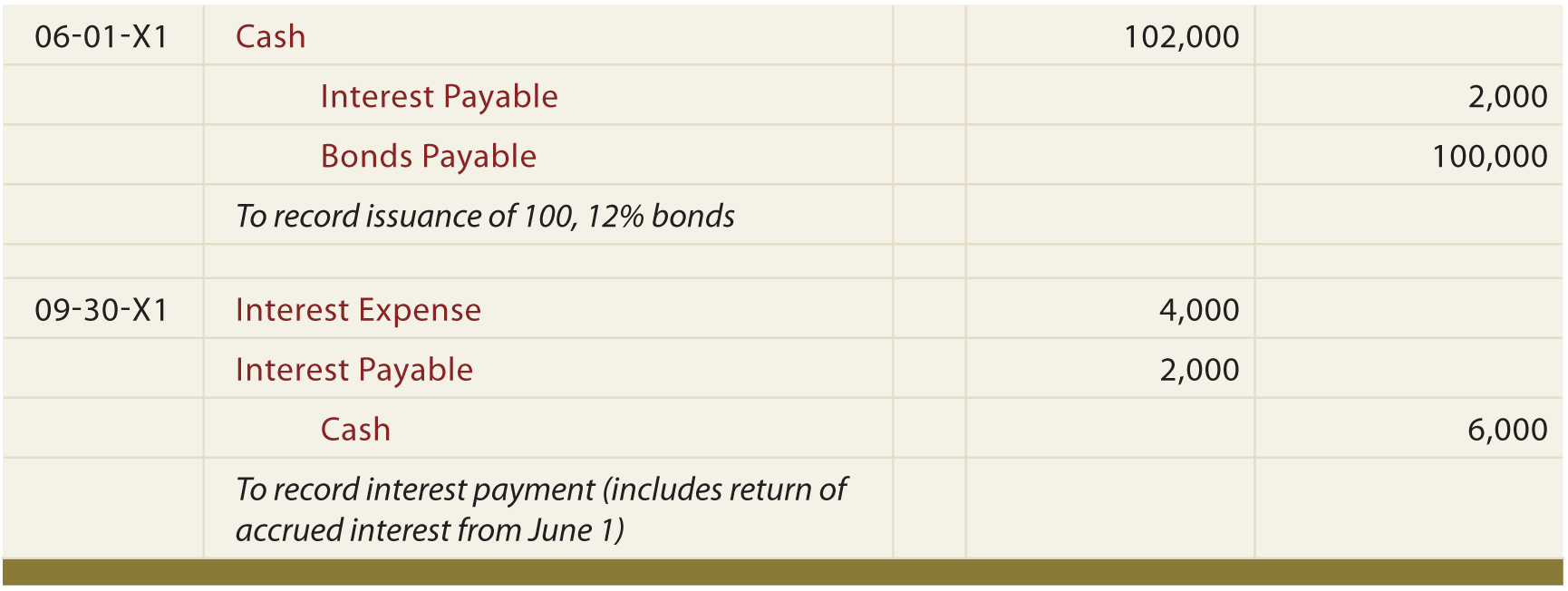

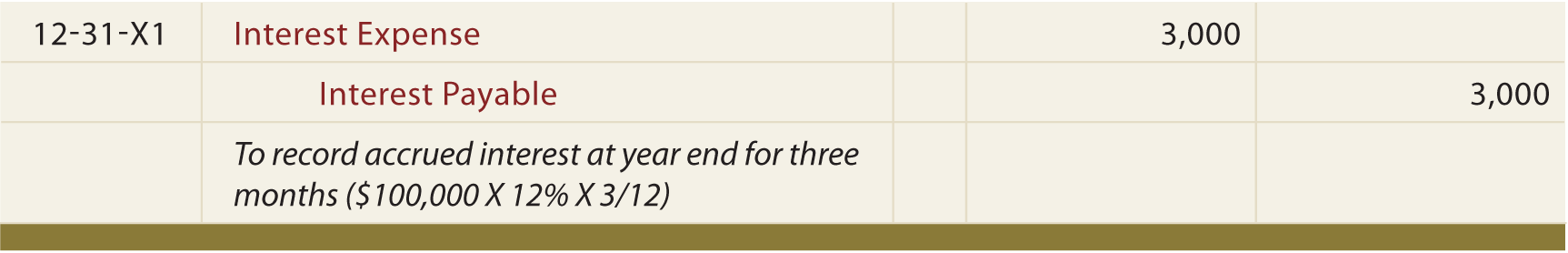

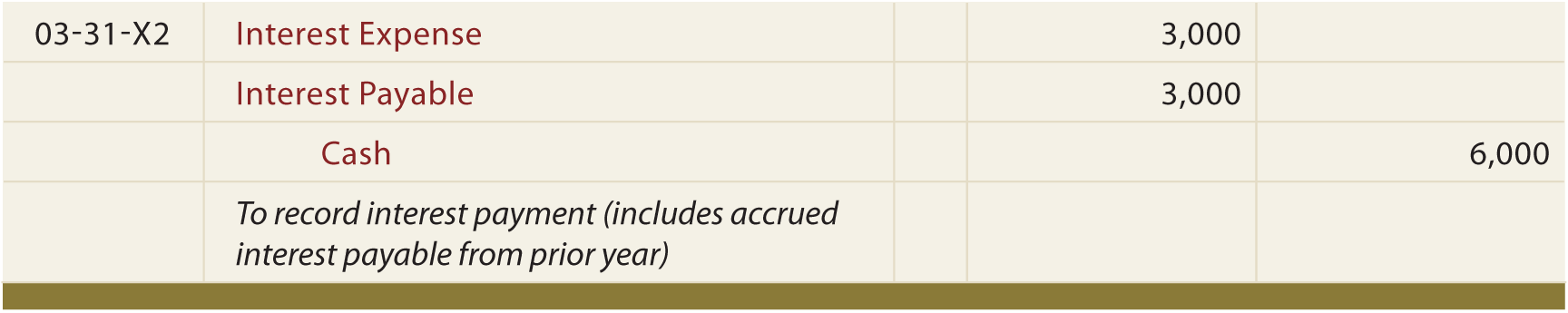

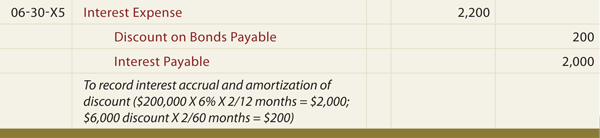

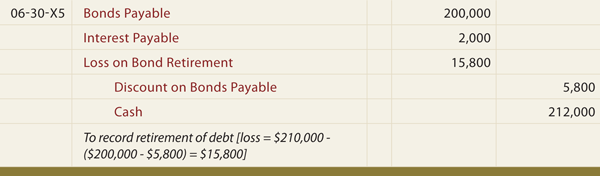

Bonds issued between interest dates are best understood in the context of a specific example. Suppose Thompson Corporation proposed to issue $100,000 of 12% bonds, dated April 1, 20X1. However, despite the April 1 date, the actual issuance was slightly delayed, and the bonds were not sold until June 1. Nevertheless, the covenant pertaining to the bonds specifies that the first 6-month interest payment date will occur on September 30 in the amount of $6,000 ($100,000 X 12% X 6/12). In effect, interest for April and May has already accrued at the time the bonds are actually issued ($100,000 X 12% X 2/12 = $2,000). To be fair, Thompson will collect $2,000 from the purchasers of the bonds at the time of issue, and then return it within the $6,000 payment on September 30. This effectively causes the net difference of $4,000 to represent interest expense for June, July, August, and September ($100,000 X 12% X 4/12). The resulting journal entries are: YEAR-END INTEREST ACCRUALS:  When the next interest payment date arrives on March 31, the actual interest payment will cover the previously accrued interest, and additional amounts pertaining to January, February, and March:  If these bonds had been issued at other than par, end-of-period entries would also include adjustments of interest expense for the amortization of premiums or discounts relating to elapsed periods. BONDS RETIRED BEFORE SCHEDULED MATURITY: Whether the debt is being retired or refinanced in some other way, accounting rules dictate that the extinguished obligation be removed from the books. The difference between the old debt’s net carrying value and the amounts used for the payoff should be recognized as a gain or loss. For instance, assume that Cabano Corporation is retiring $200,000 face of its 6% bonds payable. The last semiannual interest payment occurred on April 30, and the bonds are being retired on June 30, 20X5. The unamortized discount on the bonds at April 30, 20X5, was $6,000, and there was a 5-year remaining life on the bonds as of that date. Further, Cabano is paying $210,000, plus accrued interest to date ($2,000), to retire the bonds; this “early call” price was stipulated in the original bond covenant. The first step to account for this bond retirement is to bring the accounting for interest up to date:  Then, the actual bond retirement can be recorded, with the difference between the up-to-date carrying value and the funds utilized being recorded as a loss (debit) or gain (credit). Notice that Cabano’s loss relates to the fact that it took more cash to pay off the debt than was the debt’s carrying value ($194,200 ($200,000 minus $5,800)).  THE FAIR VALUE OPTION: |

Tuesday, February 22, 2011

Bonds issued between interest dates, bond retirements, and fair value measurements

Subscribe to:

Post Comments (Atom)

Do you have to make a journal entry for April 1?

ReplyDeleteThanks