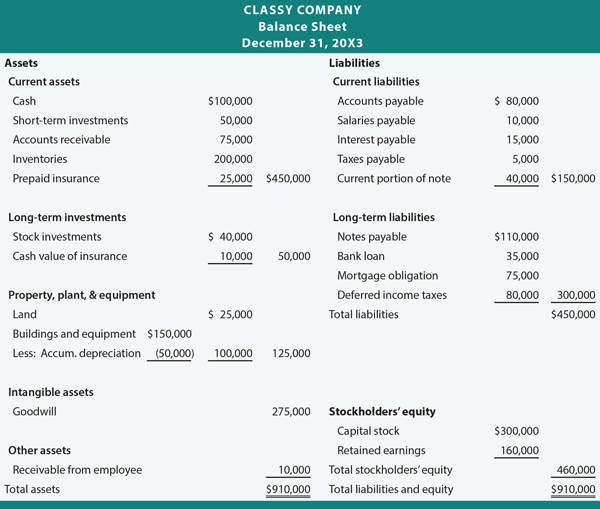

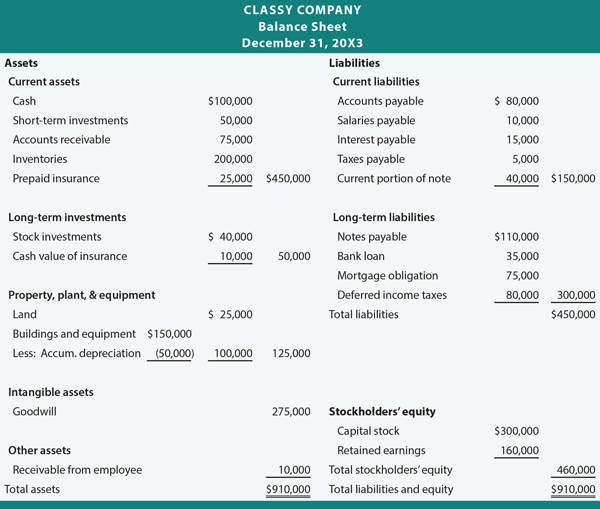

The balance sheet reveals the assets, liabilities, and equity of a company. In examining a balance sheet, always be mindful that all components listed in a balance sheet are not necessarily at fair value. Some assets are carried at historical cost, and other assets are not reported at all (such as the value of a company's brand name, patents, and other internally developed resources). Nevertheless, careful examination of the balance sheet is essential to analysis of a company's overall financial condition. To facilitate proper analysis, accountants will often divide the balance sheet into categories or classifications. The result is that important groups of accounts can be identified and subtotaled. Such balance sheets are called "classified balance sheets."

The asset side of the balance sheet may be divided into as many as five separate sections (when applicable): Current assets; long-term investments; Property, plant and equipment; Intangible assets; and other assets. The contents of each category are determined based upon the following general rules:

Just as the asset side of the balance sheet may be divided, so too for the liability section. The liability section is customarily divided into:

The appropriate financial statement presentation for equity depends on the nature of the business organization for which it is prepared. Businesses generally may be organized as sole proprietorships, partnerships or corporations. The illustrations in this book generally assume that the business is incorporated. Therefore, the equity section consists of:

There is nothing that requires that a business activity be conducted through a corporation. A sole proprietorship is an enterprise owned by one person. If the preceding classified balance sheet illustration was instead being prepared for a sole proprietorship, it would look the same except that the equity section would consist of a single owner's capital account (instead of capital stock and retained earnings). If several persons are involved in a business that is not incorporated, it is likely a partnership. Again, the balance sheet would be unchanged except for the equity section; the equity section would be divided into separate accounts for each partner (representing each partner's residual interest in the business). Recent years have seen a spate of legislation creating variants of these entity forms (limited liability companies/llC, limited liability partnerships/llP, etc.), but the overall balance sheet structure is relatively unaffected. The terminology used to describe entity forms and equity capital structure also varies considerably around the world, but there is very little substantive difference in the underlying characteristics or the general appearance and content of the balance sheet.

There is nothing that requires that a business activity be conducted through a corporation. A sole proprietorship is an enterprise owned by one person. If the preceding classified balance sheet illustration was instead being prepared for a sole proprietorship, it would look the same except that the equity section would consist of a single owner's capital account (instead of capital stock and retained earnings). If several persons are involved in a business that is not incorporated, it is likely a partnership. Again, the balance sheet would be unchanged except for the equity section; the equity section would be divided into separate accounts for each partner (representing each partner's residual interest in the business). Recent years have seen a spate of legislation creating variants of these entity forms (limited liability companies/llC, limited liability partnerships/llP, etc.), but the overall balance sheet structure is relatively unaffected. The terminology used to describe entity forms and equity capital structure also varies considerably around the world, but there is very little substantive difference in the underlying characteristics or the general appearance and content of the balance sheet.

The asset side of the balance sheet may be divided into as many as five separate sections (when applicable): Current assets; long-term investments; Property, plant and equipment; Intangible assets; and other assets. The contents of each category are determined based upon the following general rules:

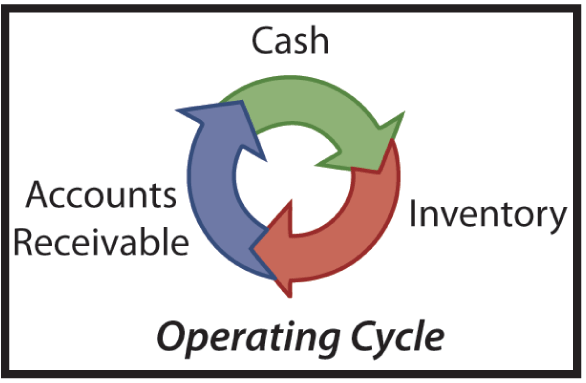

Current Assets include cash and those assets that will be converted into cash or consumed in a relatively short period of time; specifically, those assets that will be converted into cash or consumed within one year or the operating cycle, whichever is longer. The operating cycle for a particular company is the period of time it takes to convert cash back into cash (i.e., purchase inventory, sell the inventory on account, and collect the receivable); this is usually less than one year. In listing assets within the current section, the most liquid assets should be listed first (i.e., cash, short-term investments, and receivables). These are followed with inventories and prepaid expenses.

Current Assets include cash and those assets that will be converted into cash or consumed in a relatively short period of time; specifically, those assets that will be converted into cash or consumed within one year or the operating cycle, whichever is longer. The operating cycle for a particular company is the period of time it takes to convert cash back into cash (i.e., purchase inventory, sell the inventory on account, and collect the receivable); this is usually less than one year. In listing assets within the current section, the most liquid assets should be listed first (i.e., cash, short-term investments, and receivables). These are followed with inventories and prepaid expenses.- Long-term Investments include land purchased for speculation, funds set aside for a plant expansion program, funds redeemable from insurance policies (e.g., cash surrender value of life insurance), and investments in other entities.

- Property, Plant, and Equipment includes the land, buildings, and equipment productively in use by the company.

- Intangible Assets lack physical existence, and include items like purchased patents and copyrights, "goodwill" (the amount by which the fair value of a purchased business exceeds that entity's identifiable net assets), rights under a franchise agreement, and similar items.

- Other Assets is the section used to report asset accounts that just don't seem to fit elsewhere, such as a special long-term receivable.

LIABILITIES:

- Current Liabilities are those obligations that will be liquidated within one year or the operating cycle, whichever is longer. Normally, current liabilities are paid with current assets.

- Long-term Liabilities relate to any obligation that is not current, and include bank loans, mortgage notes, certain deferred taxes, and the like. Importantly, some long-term notes may be classified partially as a current liability and partially as a long-term liability. The portion classified as current would be the principal amount to be repaid within the next year (or operating cycle, if longer). Any amounts due after that period of time would be shown as a long-term liability.

EQUITY:

- Capital Stock includes the amounts received from investors for the stock of the company. The investors become the owners of the company, and that ownership interest is represented by shares that can be transferred to others (without further involvement by the company). In actuality, the legalese of stock issues can become quite involved, and one is apt to encounter expanded capital stock related accounts (such as preferred stock, common stock, paid-in-capital in excess of par, and so on). Those advanced issues are covered in subsequent chapters.

- Retained Earnings should be familiar, representing the accumulated income less the dividends. In essence, it is the profit that has been retained and plowed back (reinvested) into expansion of the business.

OTHER ENTITY FORMS:

NOTES TO THE FINANCIAL STATEMENTS:

Financial statements, by themselves, may not tell the whole story. Many important details about a company cannot be described in money on the balance sheet. Notes are used to describe accounting policies, major business events, pending lawsuits, and other facets of operation. The principle of full disclosure means that financial statements result in a fair presentation and that all facts which would influence investors' and creditors' judgments about the company are disclosed in the financial statements or related notes. oftentimes, the notes will be more voluminous than the financial statements themselves.

No comments:

Post a Comment

Thanks For Comment!!