Companies may issue different types of stock. For example, some companies have multiple classes of common stock. A “family business” that has grown very large and become a public company may be accompanied by the creation of Class A stock (held by the family members) and Class B stock (held by the public), where only the Class A stock can vote. This enables raising needed capital but preserves the ability to control and direct the company. While common stock is the most typical, another way to gain access to capital is by issuing preferred stock. The customary features of common and preferred differ, providing some advantages and disadvantages for each. The following tables reveal general features that can be modified on a company by company basis.

Typical common stock features: Possible Preferred stock features:

A comparative review of the preceding tables reveals a broad range of potential attributes. Every company has different financing and tax considerations and will tailor its package of features to match those issues. For instance, a company can issue preferred that is much like debt (cumulative, mandatory redeemable), because a fixed periodic payment must occur each period with a fixed amount due at maturity. On the other hand, some preferred will behave more like common stock (noncallable, noncumulative, convertible).

WHAT IS PAR? In the preceding discussion, there were several references to par value. Many states require that stock have a designated par value (or in some cases “stated value”). Thus, par value is said to represent the “legal capital” of the firm. In theory, original purchasers of stock are contingently liable to the company for the difference between the issue price and par value if the stock is issued at less than par. However, as a practical matter, par values on common stock are set well below the issue price, negating any practical effect of this latent provision. It is not unusual to see common stock carry a par value of $1 per share or even $.01 per share. In some respects, then, par value is merely a formality. But, it does impact the accounting records, because separate accounts must be maintained for “par” and paid-in capital in excess of par. Assume that Godkneckt Corporation issues 100,000 shares of $1 par value stock for $10 per share. The entry to record this stock issuance would be:

Occasionally, a corporation may issue no-par stock, which is recorded by debiting Cash and crediting Common Stock for the issue price. A separate Paid-in Capital in Excess of Par account is not needed.

Sometimes, stock may be issued for land or other tangible assets, in which case the debit in the preceding entry would be to the specific asset account (e.g., Land instead of Cash). When stock is issued for noncash assets, the amount of the entry would be based upon the fair value of the asset (or the fair value of the stock if it can be more clearly determined).

A CLOSER LOOK AT CASH DIVIDENDS: Begin by assuming that a company has only common shares outstanding. There is no mandatory dividend requirement, and the dividends are a matter of discretion for the board of directors to consider. To pay a dividend the company must have sufficient cash and a positive balance in retained earnings (companies with a “deficit” (negative) Retained Earnings account would not pay a dividend unless it is part of a corporate liquidation action). Many companies pride themselves in having a long-standing history of regular and increasing dividends, a feature that many investors find appealing. Other companies view their objective as one of continual growth via reinvestment of all earnings; their investors seem content relying on the notion that their investment value will gradually increase due to this earnings reinvestment activity. Whatever the case, a company has no obligation to pay a dividend, and there is no “liability” for dividends until such time as they are actually declared. A “declaration” is a formal action by the board of directors to indicate that a dividend will be paid at some stipulated future date. On the date of declaration, the following entry is needed on the corporate accounts:

In observing the preceding entry, it is imperative to note that the declaration on July 1 establishes a liability to the shareholders that is legally enforceable. Therefore, a liability is recorded on the books at the time of declaration. Recall (from earlier chapters) that the Dividends account will directly reduce retained earnings (it is not an expense in calculating income, it is a distribution of income)! When the previously declared dividends are paid, the appropriate entry would entail a debit to Dividends Payable and a credit to Cash.

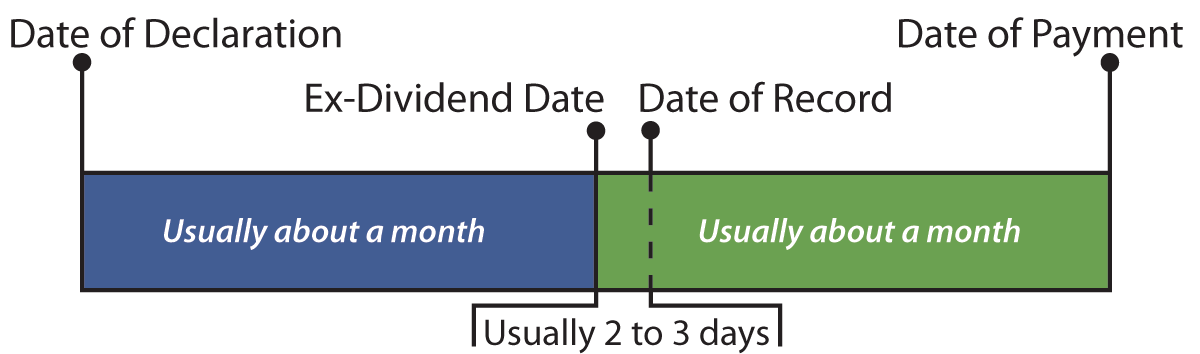

Dividend Dates: Some shareholders may sell their stock between the date of declaration and the date of payment. Who is to get the dividend? The former shareholder or the new shareholder? To resolve this question, the board will also set a “date of record;” the dividend will be paid to whomever the owner of record is on the date of record. In the preceding illustration, the date of record might have been set as August 1, for example. To further confuse matters, there may be a slight lag of just a few days between the time a share exchange occurs and the company records are updated. As a result, the date of record is usually slightly preceded by an ex-dividend date.

The practical effect of the ex-dividend date is simple: if a shareholder on the date of declaration continues to hold the stock at least through the ex-dividend date, that shareholder will get the dividend. But, if the shareholder sells the stock before the ex-dividend date, the new shareholder can expect the dividend. In the illustrated timeline, if one were to own stock on the date of declaration, that person must hold the stock at least until the “green period” to be entitled to receive payment. The practical effect of the ex-dividend date is simple: if a shareholder on the date of declaration continues to hold the stock at least through the ex-dividend date, that shareholder will get the dividend. But, if the shareholder sells the stock before the ex-dividend date, the new shareholder can expect the dividend. In the illustrated timeline, if one were to own stock on the date of declaration, that person must hold the stock at least until the “green period” to be entitled to receive payment.

THE PRESENCE OF PREFERRED STOCK: Recall that preferred dividends are expected to be paid before common dividends, and those dividends are usually a fixed amount (e.g., a percentage of the preferred’s par value). In addition, recall that cumulative preferred requires that unpaid dividends become “dividends in arrears.” Dividends in arrears must also be paid before any distributions to common can occur. Another illustration will likely provide the answer to questions about how these concepts are to be implemented.

To develop the illustration, begin by looking at the equity section of Embassy Corporation’s balance sheet. Note that this section of the balance sheet is quite extensive. A corporation’s stockholders’ equity (or related footnotes) should include rather detailed descriptions of the type of stock outstanding and its basic features. This will include mention of the number of shares authorized (permitted to be issued), issued (actually issued), and outstanding (issued minus any shares reacquired by the company). In addition, be aware of certain related terminology: legal capital is the total par value ($20,400,000 for Embassy), and total paid-in capital is the legal capital plus amounts paid in excess of par values ($56,400,000 for Embassy).

Note that the par value for each class of stock is the number of shares issued multiplied by the par value per share (e.g., 200,000 shares X $100 per share = $20,000,000). The preferred stock description makes it clear that the $100 par stock is 8% cumulative. This means that each share will receive $8 per year in dividends, and any “missed” dividends become dividends in arrears. If the notes to the financial statements appropriately indicate that Embassy has not managed to pay its dividends for the preceding two years, and Embassy desired to pay $5,000,000 of total dividends during the current year, how much would be available to the common shareholders? The answer is only $200,000 (or $0.50 per share for the 400,000 common shares). The reason is that the preferred stock is to receive annual dividends of $1,600,000 ($8 per share X 200,000 preferred shares), and three years must be paid consisting of the two years in arrears and the current year requirement ($1,600,000 X 3 years = $4,800,000 to preferred, leaving only $200,000 for common). |

No comments:

Post a Comment

Thanks For Comment!!