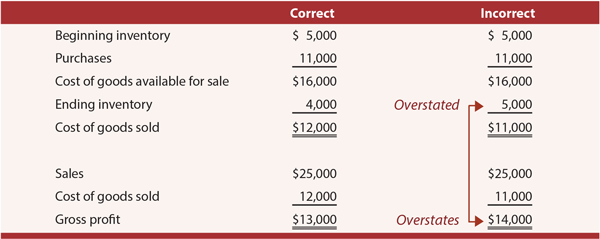

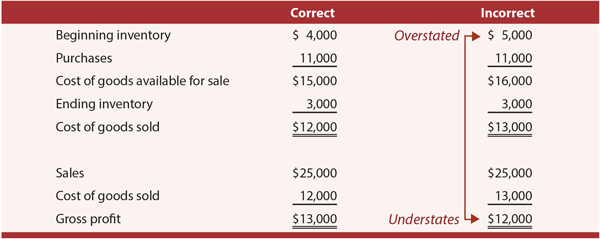

| The best run companies will minimize their investment in inventory. Inventory is costly and involves the potential for loss and spoilage. In the alternative, being out of stock may result in lost customers, so a delicate balance must be maintained. Careful attention must be paid to the inventory levels. One ratio that is often used to monitor inventory is the Inventory Turnover Ratio. This ratio shows the number of times that a firm's inventory balance was turned ("sold") during a year. It is calculated by dividing cost of sales by the average inventory level: Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory INVENTORY ERRORS:  Had the above inventory error been an understatement ($3,000 instead of the correct $4,000), then the ripple effect would have caused an understatement of income by $1,000. Inventory errors tend to be counterbalancing. That is, one year's ending inventory error becomes the next year's beginning inventory error. The general rule of thumb is that overstatements of beginning inventory cause that year's income to be understated, and vice versa. Examine the following table where the only error relates to beginning inventory balances:  Hence, if the above illustrations related to two consecutive years, the total income would be correct ($13,000 + $13,000 = $14,000 + $12,000). However, the amount for each year is critically flawed. |

Sunday, February 20, 2011

Inventory management and monitoring, and the impact of errors

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Thanks For Comment!!