Most everyone is intimidated by new concepts and terminology (like debits, credits, journals, etc.). But, learning can be made quite simple by relating new concepts to preexisting notions that are already well understood. So, think: what is already known about a journal (not an accounting journal, just any journal)? It's just a log book, right? A place where one can record a history of transactions and events, usually in date (chronological) order. Perhaps one maintains a personal journal of important events in life, or record notes when they travel.

Likewise, an accounting journal is just a log book that contains a chronological listing of a company's transactions and events. The accounting journal serves to document business activity as it occurs. However, rather than including a detailed narrative description of a company's transactions and events, the journal lists the items by a form of shorthand notation. Specifically, the notation indicates the accounts involved, and whether each is debited or credited. Remember what was said at the beginning of the chapter:

The general journal is sometimes called the book of original entry. This means that source documents are reviewed and interpreted as to the accounts involved. Then, they are documented in the journal via their debit/credit format. As such the general journal becomes a log book of the recordable transactions and events. The journal is not sufficient, by itself, to prepare financial statements. That objective is fulfilled by subsequent steps. But, maintaining the journal is the point of beginning toward that end objective.

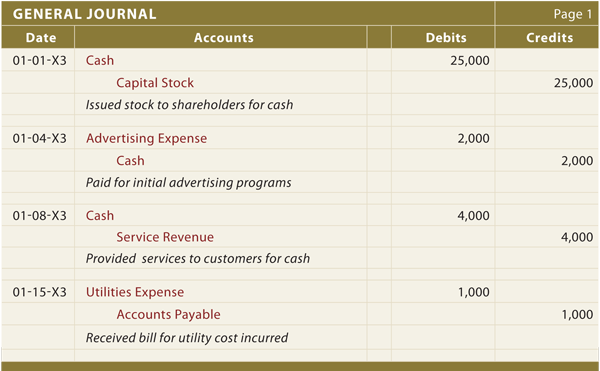

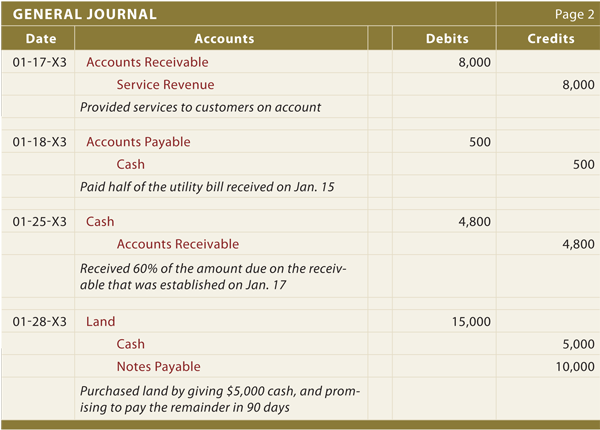

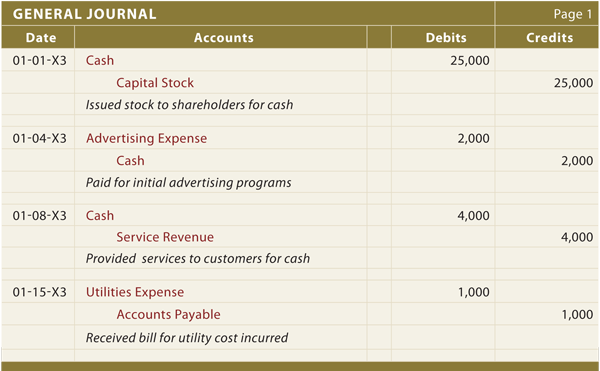

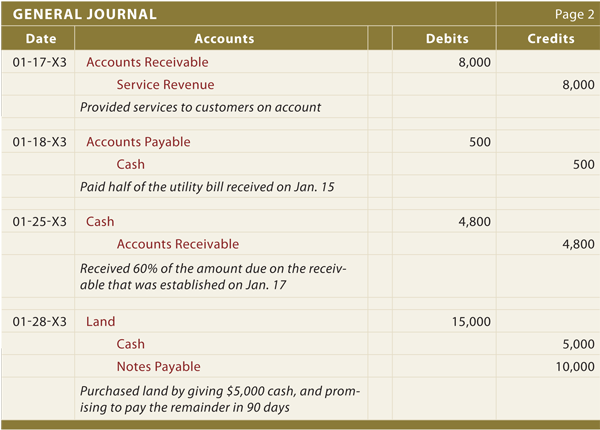

For instance, the first transaction increases both cash and equity. Cash, an asset account, is increased via a debit. Capital stock, an equity account, is increased via a credit. The next transaction increases Advertising Expense "with a debit" and decreases Cash "with a credit."

Note that each transaction is followed by a brief narrative description; this is a good practice to provide further documentation. For each transaction, it is customary to list "debits" first (flush left), then the credits (indented right). Finally, notice that a transaction may involve more than two accounts (as in the January 28 transaction); the corresponding journal entry for these complex transactions is called a "compound" entry.

In reviewing the general journal for Xao, note that it is only two pages long. An actual journal for a business might consume hundreds and thousands of pages to document its many transactions. As a result, some businesses may maintain the journal in electronic form only.

Having reviewed the journal entries for January, consider a few more points.

Having reviewed the journal entries for January, consider a few more points.

For example, a business may have huge volumes of redundant transactions that involve cash receipts. Thus, the company might have a special cash receipts journal. Any transaction entailing a cash receipt would be recorded therein. Indeed, the summary total of all transactions in this journal could correspond to the debits to the Cash account, further simplifying the accounting process. Other special journals might be used for cash payments, sales, purchases, payroll, and so forth.

The special journals do not replace the general journal. Instead, they just strip out recurring type transactions and place them in their own separate journal. The transaction descriptions associated with each transaction found in the general journal are not normally needed in a special journal, given that each transaction is redundant in nature. Without special journals, a general journal can become quite voluminous.

Likewise, an accounting journal is just a log book that contains a chronological listing of a company's transactions and events. The accounting journal serves to document business activity as it occurs. However, rather than including a detailed narrative description of a company's transactions and events, the journal lists the items by a form of shorthand notation. Specifically, the notation indicates the accounts involved, and whether each is debited or credited. Remember what was said at the beginning of the chapter:

The journal satisfies the need for this logging process!The system must be sufficient to fuel the preparation of the financial statements, and be capable of maintaining retrievable documentation for each and every transaction. In other words, some transaction logging process must be in place.

The general journal is sometimes called the book of original entry. This means that source documents are reviewed and interpreted as to the accounts involved. Then, they are documented in the journal via their debit/credit format. As such the general journal becomes a log book of the recordable transactions and events. The journal is not sufficient, by itself, to prepare financial statements. That objective is fulfilled by subsequent steps. But, maintaining the journal is the point of beginning toward that end objective.

Journal example:

The following illustration draws upon the facts for the Xao Corporation. Specifically it shows the journalizing process for Xao’s transactions. Review it carefully, specifically noting that it is in chronological order with each transaction of the business being reduced to the short-hand description of its debit/credit effects.For instance, the first transaction increases both cash and equity. Cash, an asset account, is increased via a debit. Capital stock, an equity account, is increased via a credit. The next transaction increases Advertising Expense "with a debit" and decreases Cash "with a credit."

Note that each transaction is followed by a brief narrative description; this is a good practice to provide further documentation. For each transaction, it is customary to list "debits" first (flush left), then the credits (indented right). Finally, notice that a transaction may involve more than two accounts (as in the January 28 transaction); the corresponding journal entry for these complex transactions is called a "compound" entry.

In reviewing the general journal for Xao, note that it is only two pages long. An actual journal for a business might consume hundreds and thousands of pages to document its many transactions. As a result, some businesses may maintain the journal in electronic form only.

Special Journals:

First, the illustrated journal was referred to as a "general" journal. Most businesses will maintain a general journal. Any and all transactions can be recorded in the general journal. However, a business may sometimes find it beneficial to employ optional "special journals." Special journals are deployed for highly redundant transactions.For example, a business may have huge volumes of redundant transactions that involve cash receipts. Thus, the company might have a special cash receipts journal. Any transaction entailing a cash receipt would be recorded therein. Indeed, the summary total of all transactions in this journal could correspond to the debits to the Cash account, further simplifying the accounting process. Other special journals might be used for cash payments, sales, purchases, payroll, and so forth.

The special journals do not replace the general journal. Instead, they just strip out recurring type transactions and place them in their own separate journal. The transaction descriptions associated with each transaction found in the general journal are not normally needed in a special journal, given that each transaction is redundant in nature. Without special journals, a general journal can become quite voluminous.

Page Numbering

Second, notice that the illustrated journal consisted of two pages (labeled Page 1 and Page 2). Although the journal is chronological, it is helpful to have the page number indexing for transaction cross-referencing and working backward from financial statement amounts to individual transactions. The benefits of this type of indexing will become apparent in the general ledger exhibits within the following section of the chapter. As an alternative, some companies will assign a unique index number to each transaction, further facilitating the ability to trace transactions throughout the entire accounting system.Recap

The general journal is a great tool to capture transaction and event details, but it certainly does nothing to tell a company about the balance in each specific account. For instance, how much cash does Xao Corporation have at the end of January? One could go through the journal and net the debits and credits to Cash ($25,000 - $2,000 + $4,000 - $500 + $4,800 - $5,000 = $26,300). But, this is tedious and highly susceptible to error. It would become virtually impossible if the journal were hundreds of pages long. A better way is needed. This is where the general ledger comes into play.

No comments:

Post a Comment

Thanks For Comment!!