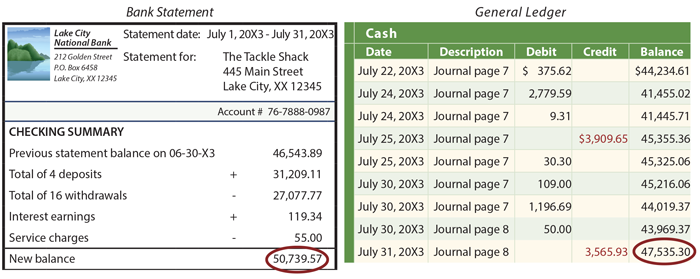

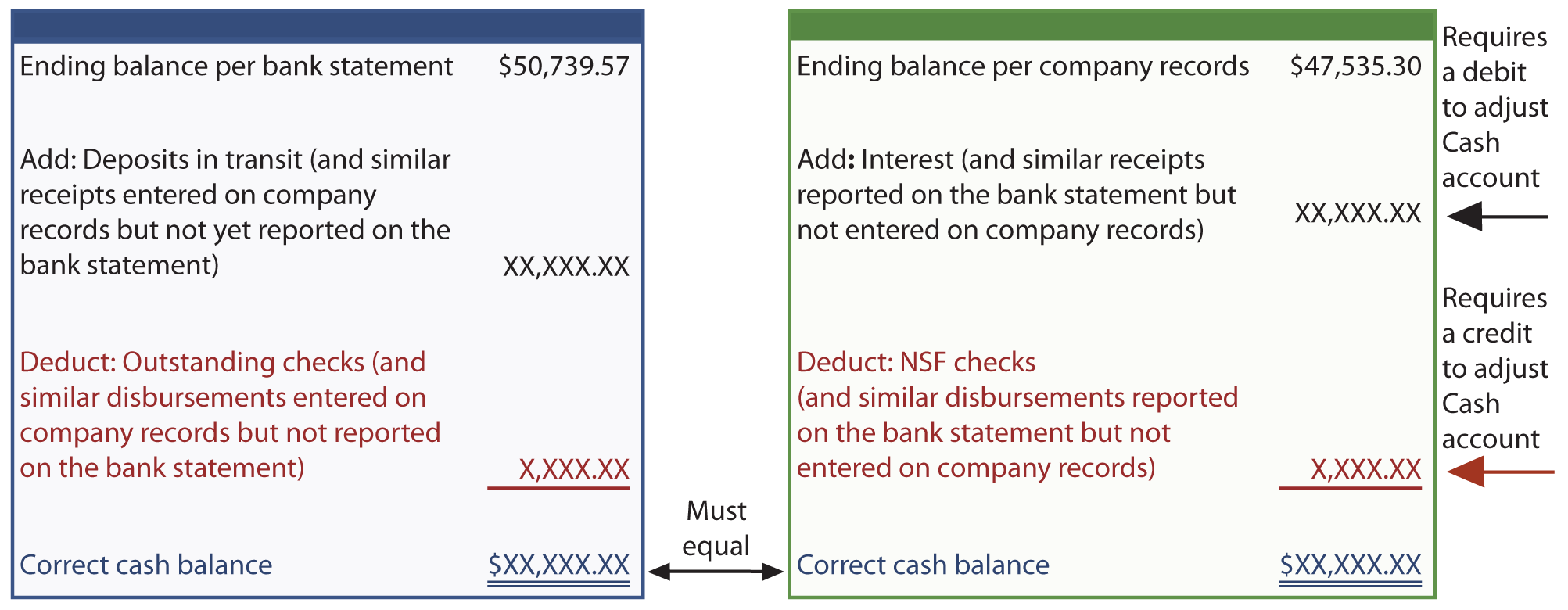

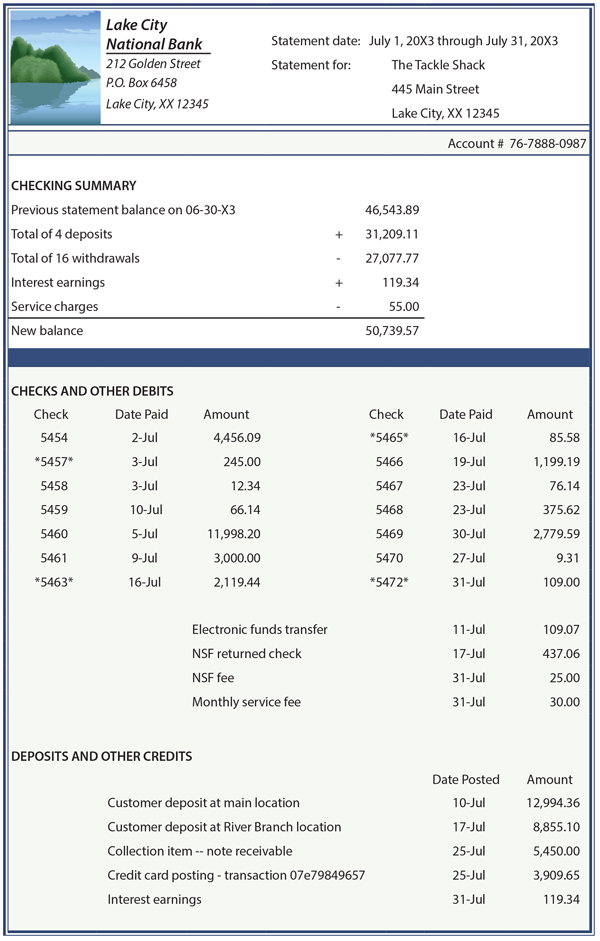

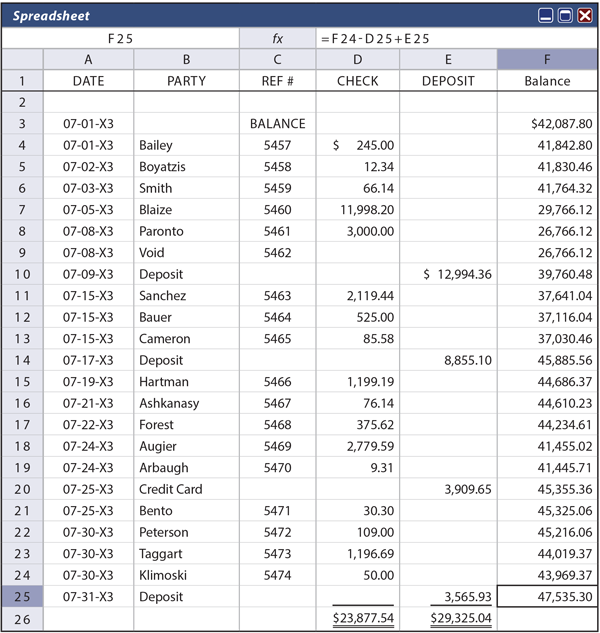

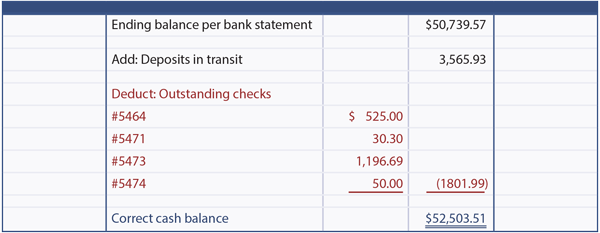

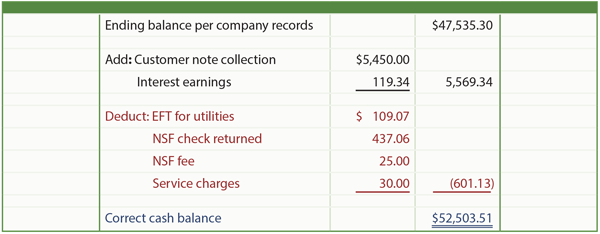

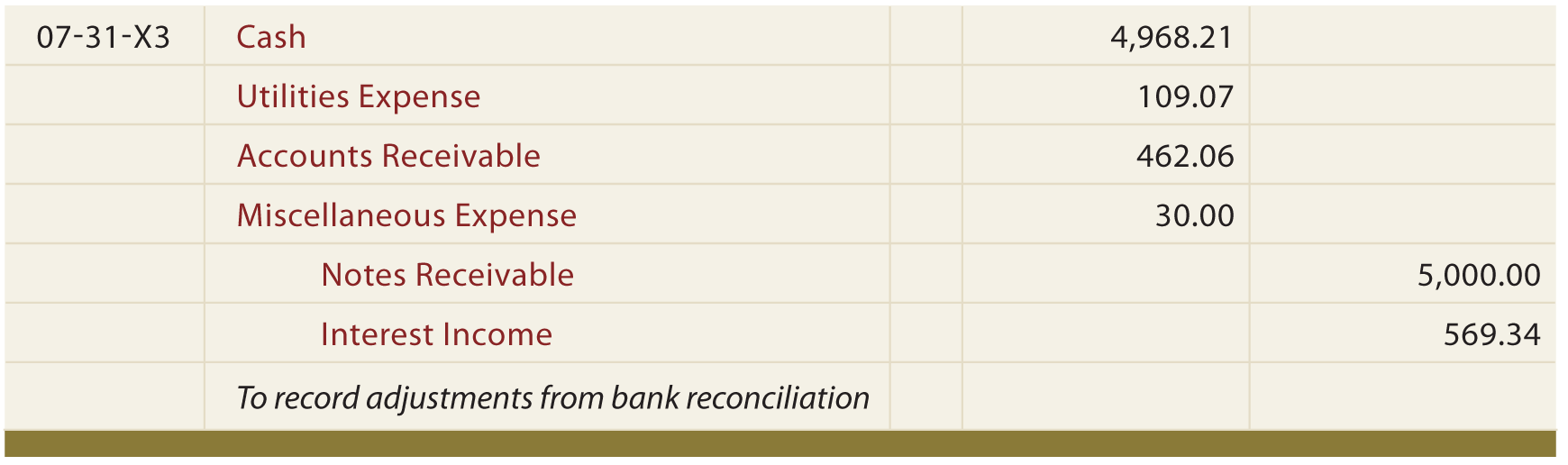

| One of the most common cash control procedures is the bank reconciliation. In business, every bank statement should be promptly reconciled by a person not otherwise involved in the cash receipts and disbursements functions. The reconciliation is needed to identify errors, irregularities, and adjustments for the Cash account. Having an independent person prepare the reconciliation helps establish separation of duties and deters fraud by requiring collusion for unauthorized actions. There are many different formats for the reconciliation process, but they all accomplish the same objective. The reconciliation compares the amount of cash shown on the monthly bank statement (the document received from a bank which summarizes deposits and other credits, and checks and other debits) with the amount of cash reported in the general ledger. These two balances will frequently differ as shown in the following illustration:  The following format is typical of one used in the reconciliation process. Note that the balance per the bank statement is reconciled to the "correct" amount of cash; likewise, the balance per company records is reconciled to the "correct" amount. These amounts must agree. Once the correct adjusted cash balance is satisfactorily calculated, journal entries must be prepared for all items identified in the reconciliation of the ending balance per company records to the correct cash balance. These entries serve to record the transactions and events which impact cash but have not been previously journalized (e.g., NSF checks, bank service charges, interest income, and so on).  example The following pages include a detailed illustration of the bank reconciliation process. Begin by carefully reviewing the bank statement for The Tackle Shop found on the next page. Then look at the company's check register spreadsheet that follows. Information found on that spreadsheet would correlate precisely to activity in the company's Cash account within the general ledger. The following additional information must also be considered:

Bank Statement  check register     PROOF OF CASH Many businesses prepare a reconciliation just like that illustrated. However, this approach leaves one gapping hole in the control process. What if the bank statement included a $5,000 check to an employee near the beginning of the month, and a $5,000 deposit by that employee near the end of the month (and these amounts were not recorded on the company records)? In other words, the employee took out an unauthorized "loan" for a while. The reconciliation would not reveal this unauthorized activity because the ending balances are correct and in agreement. To overcome this deficiency, some companies will reconcile not only the beginning and ending balances, but also the total checks per the bank statement to the total disbursements per the company records, and the total deposits per the bank statement to the total receipts on the company accounts. If a problem exists, the totals on the bank statement will exceed the totals per the company records for both receipts and disbursements. This added reconciliation technique is termed a proof of cash. It is highly recommended where the volume of transactions and amount of money involved is very large.Also illegal is "kiting." Kiting occurs when one opens numerous bank accounts at various locations and then proceeds to write checks on one account and deposit them to another. In turn, checks are written on that account, and deposited to yet another bank. And, over and over and over. Each of the bank accounts may appear to have money, but it is illusionary, because there are numerous checks "floating" about that will hit and reduce the accounts. Somewhere in the process the perpetrator makes a cash withdrawal and then vanishes. That is why one will often see bank notices that deposited funds cannot be withdrawn for several days. Such restrictions are intended to make sure that a deposit clears the bank on which it is drawn before releasing those funds. Kiting is complex and illegal. Enhanced electronic clearing procedures adopted by banks in recent years have made kiting far more difficult to accomplish. |

Wednesday, February 16, 2011

Reconciliation of bank accounts

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Thanks For Comment!!