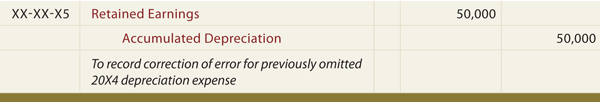

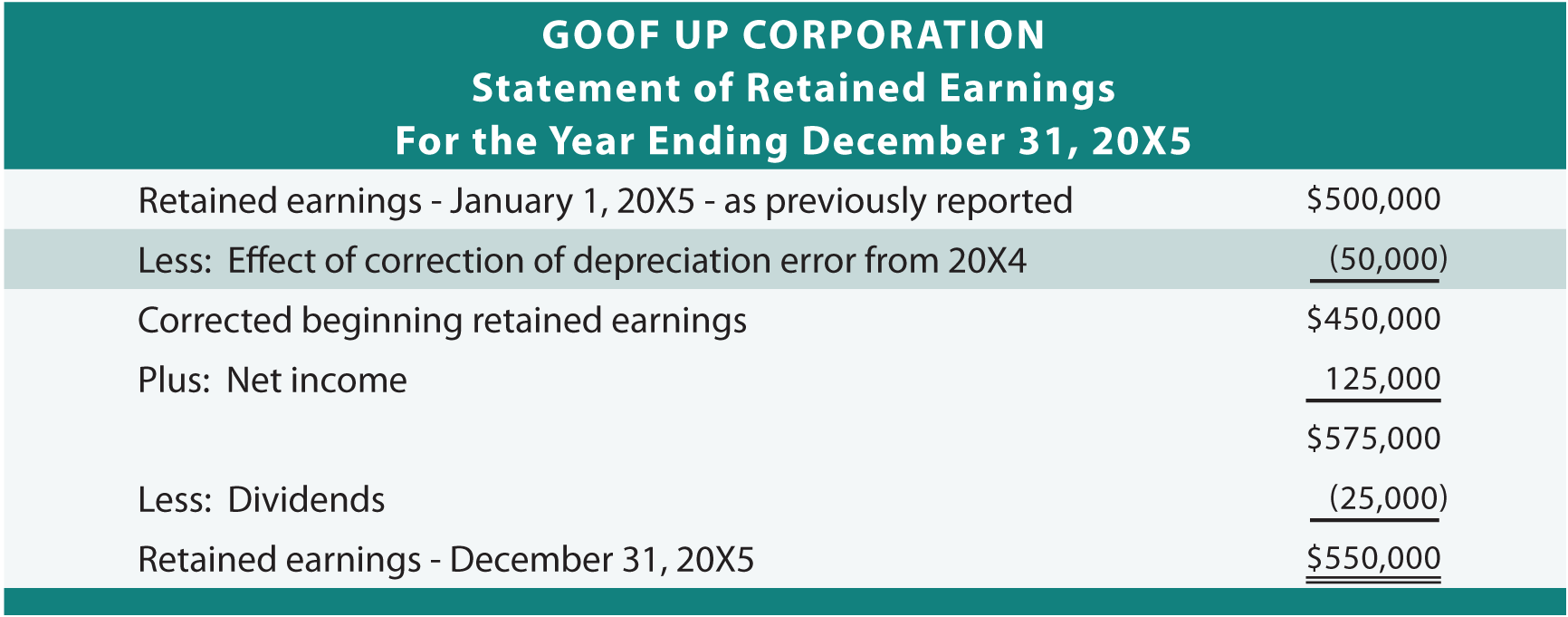

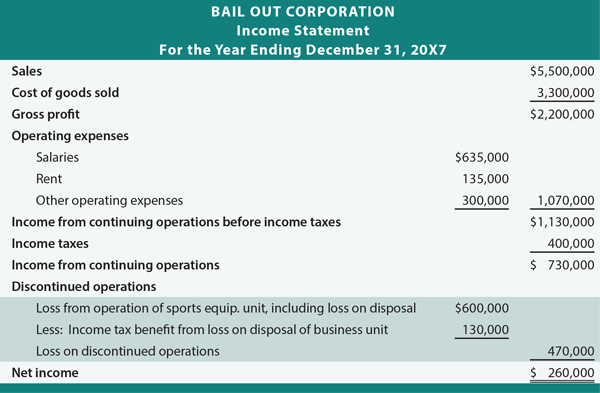

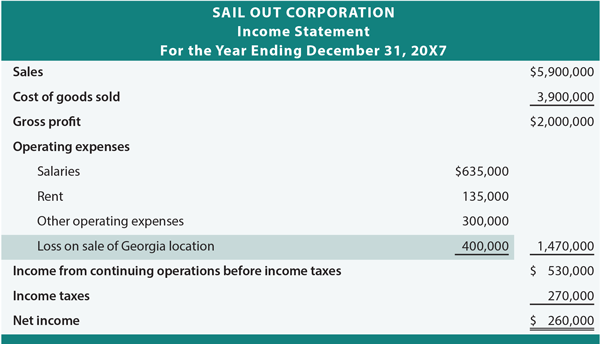

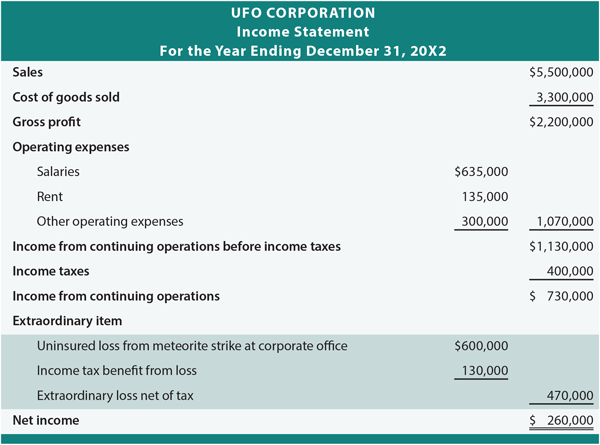

| The accounting profession uses an “all inclusive” approach to measuring income. Virtually all transactions, other than shareholder related transactions like issuing stock and paying dividends, are eventually channeled through the income statement. However, there are certain situations where the accounting rules have evolved in sophistication to provide special disclosures. The reason for the added disclosure is to make it easier for users of financial statements to sort out the effects that are related to ongoing operations versus those that are somehow unique. The following discussion will highlight the correct handling of special situations. CORRECTIONS OF ERRORS: The temptation is to simply force the books into balance by making a compensating error in the current period. For example, assume that a company failed to depreciate an asset in 20X4, and this fact is discovered in 20X5. Why not just catch up by “double depreciating” the asset in 20X5, and then everything will be fine, right? Wrong! While it is true that accumulated depreciation in the balance sheet would be back on track at the end of 20X5, income for 20X4 and 20X5 would now both be wrong. It is not technically correct to handle errors this way. Instead, USA generally accepted accounting principles dictate that error corrections (if material) must be handled by prior period adjustment. This means that the financial statements of prior periods must be subjected to a restatement to make them correct. In essence, the financial statements of prior periods are redone to reflect the correct amounts. Global GAAP follows a similar approach, but provides an exception for adjustments that are impractical to determine.  The following 20X5 entry reveals the method of adjusting the general ledger for failure to record depreciation in 20X4. The debit to Retained Earnings reflects the expense that would have been recorded and closed to Retained Earnings in the prior year, while the credit to Accumulated Depreciation provides a catch up adjustment to reflect the account’s correct balance. The following 20X5 entry reveals the method of adjusting the general ledger for failure to record depreciation in 20X4. The debit to Retained Earnings reflects the expense that would have been recorded and closed to Retained Earnings in the prior year, while the credit to Accumulated Depreciation provides a catch up adjustment to reflect the account’s correct balance. Importantly, if comparative financial statements (i.e., side-by-side financial statements, for two or more years) are presented for 20X4 and 20X5, depreciation would be reported at the correct amounts in each years’ statements (along with a note indicating that the prior years’ data have been revised for an error correction). If an error related to prior periods for which comparative data are not presented, then the statement of retained earnings would be amended as follows:  DISCONTINUED OPERATIONS: When an entity disposes of a complete business component, it will invoke the unique reporting rules related to discontinued operations. To trigger these rules requires that the disposed business component have operations that are clearly distinguishable operationally and for reporting purposes. This would typically relate to a separate business segment, unit, subsidiary, or group of assets. Following is an illustrative income statement for Bail Out Corporation. Bail Out distributes farming implements and sporting goods. During 20X7, Bail Out sold its sporting equipment business and began to focus only on farm implements. In examining this illustration, be aware that revenues and expenses only relate to the continuing farming equipment. All amounts relating to operations of the sporting equipment business, along with the loss on the sale of assets used in that business, are removed from the upper portion of the income statement, and placed in a separate category below income from continuing operations.   Look again at Bail Out and note that income taxes were “split” between continuing operations and discontinued operations. This method of showing tax effects for discontinued operations is mandatory, and is called intraperiod tax allocation. Intraperiod tax allocation is applicable to other items reported below continuing operations (and some prior period and selected equity adjustments), but only one income tax number is attributed to income from continuing operations. EXTRAORDINARY ITEMS:  What type of event is both unusual in nature and infrequent in occurrence? UFO Corporation was hit by a meteorite. It is rare for a meteor to hit a specific business. It is unlikely that UFO would sustain this type of loss again. On the other hand, flood losses for businesses located along a river, earthquakes for businesses in the Pacific Rim, and the like can give rise to losses that are not unusual in nature and/or may be expected to reoccur. Accounting requires professional judgement, and there is sometimes room for debate, and perhaps more than one possible solution. International accounting standards do not provide for a separate extraordinary item category. OCI: It is highly unlikely that a company would experience all of the previously discussed items within the same year. However, were that the case, its income statement might expand to look something like the following (this illustration includes the less common approach of including OCI in the statement of income, rather than recording OCI directly to equity). Take note that net income or earnings is income from continuing operations plus/minus discontinued operations and extraordinary items. Comprehensive income is net income plus other comprehensive income.  CHANGES IN ACCOUNTING METHODS: Disclosures that must accompany a change in accounting principle are extensive. Notes must indicate why the newly adopted method is preferable. In addition, a substantial presentation is required showing amounts that were previously presented versus the newly derived numbers, with a clear delineation of all changes. And, the cumulative effect of the change that relates to all years prior to the earliest financial data presented must be disclosed. Do not confuse a change in accounting method with a change in accounting estimate. Changes in estimate are handled prospectively. This type of change was illustrated in the Property, Plant, and Equipment chapter. If a change in principle cannot be separated from a change in estimate, the adjustment would be handled as a change in estimate. EBIT and EBITDA: |

Monday, February 28, 2011

Special reporting situations

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Thanks For Comment!!